What Is Investment Tax Allowance Malaysia

This is the first time a member of the Dutch royal family has declined the tax-free salary and allowance. The allowance equals a percentage of the annual amount with a maximum of 126 million euro 2021 of eligible energy investments.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

You may indicate your interest when applying for EDG.

What is investment tax allowance malaysia. Table of amendments. Form C-S Lite can be filed by those companies that qualify to file Form C-S and have an annual revenue of. How To Guides Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow.

According to the papers explaining the new policy a dividend tax without such shielding could push up the pressures on the rate of return on equity investments and lead Norwegian investors from equities to bonds property etc. The main purpose of the allowance is to prevent adverse shifts in investment and corporate financing structure as a result of the dividend tax. Capital allowance is only applicable to business activity and not for individual.

Or Foreign tax credit and tax deducted at source. Income tax maritime vessels investment allowance regulations 2016. Reg 4 investment allowance it 25880 reg 5.

Credit Card Reviews Reviews for the top credit cards in. Tax Treatment for Investment Holding Company Listed on the Bursa Malaysia 15 10. The minimum investment amount per asset is 2500 euro.

Seniors like other property owners pay capital gains tax on the sale of real estate. Bursa Malaysia 8 9. Updates and Amendments 22 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax.

Schedule agreement between the republic of fiji and the government of malaysia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. Capital Allowance Industrial Building Allowance 21 11. As announced at Budget 2021 to defray the cost of large scale deployment of automation solutions eligible businesses can also apply for the 100 Investment Allowance on the qualifying equipment costs net of grant capped at S10 million per projectThe 100 Investment Allowance scheme is available until 31 March 2023.

The Dutch government approved a royal budget of 475 million in 2021. Then the surviving spouse will have an 11700000 portability allowance plus a 3500000 estate tax exemption and can therefore pass. The gain is the difference between the adjusted basis and the sale price.

LIVE Budget 2019 Malaysia Updates Highlights. Approved projects may be granted a tax allowance known as an additional investment allowance equal to 55 100 if located in an industrial development zone of the cost of any manufacturing asset used in an industrial policy project with preferred status or 35 75 if located in an industrial development zone of the cost of any manufacturing asset used in any other approved. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business.

The right to the EIA is declared with the tax return provided the investment is reported previously in time to the Netherlands Enterprise Agency wwwrvonl. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Money Politics.

Aside from BR1M or Bantuan Rakyat 1 Malaysia to ease the burden of Malaysias low-income households there are many other government aids and subsidies that you may not be aware of. Some examples of assets that are normally used in business are motor vehicles machines office equipments and furniture. All your banking questions about credit cards debit cards personal loans home loans car loans savings and investment are answered in our comprehensive articles.

Here are 6 other government aids and subsidies to help ease your burden during the turbulent economy. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

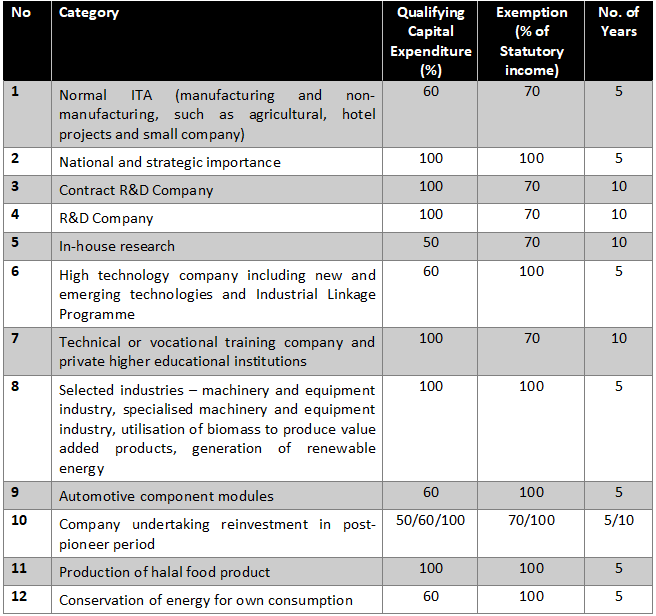

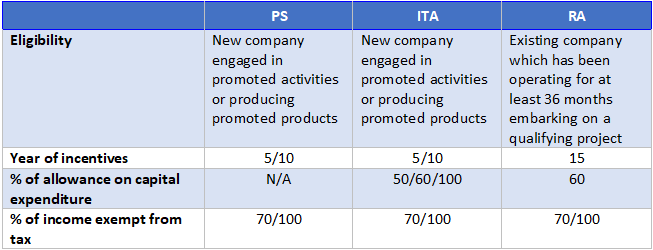

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Malaysian Companies Solar Tax Incentives By Helmi Medium

Tax Incentives For Research And Development In Malaysia Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Do You Run Or Own A Green Penang Green Council Facebook

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysian Companies Solar Tax Incentives By Helmi Medium

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

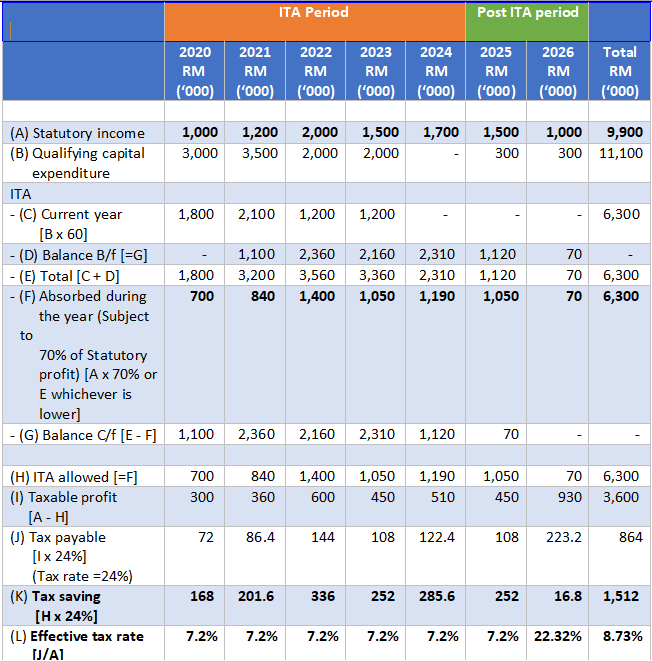

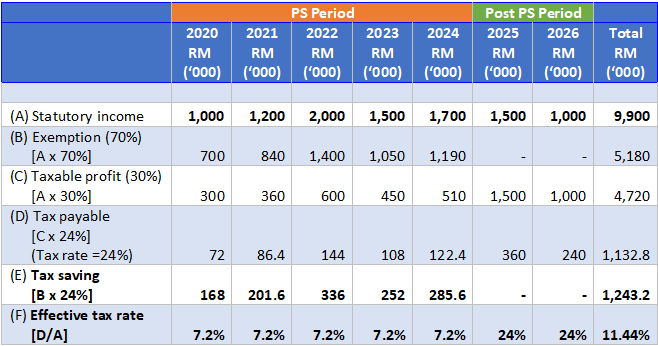

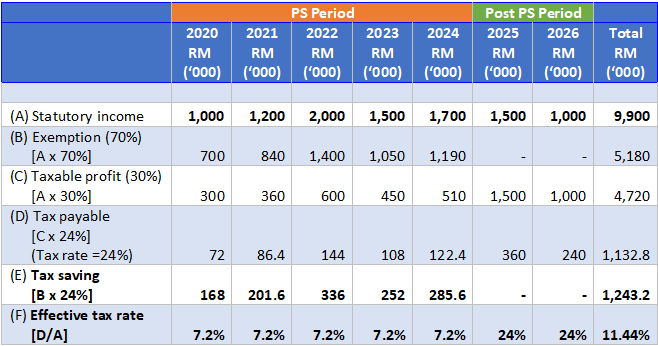

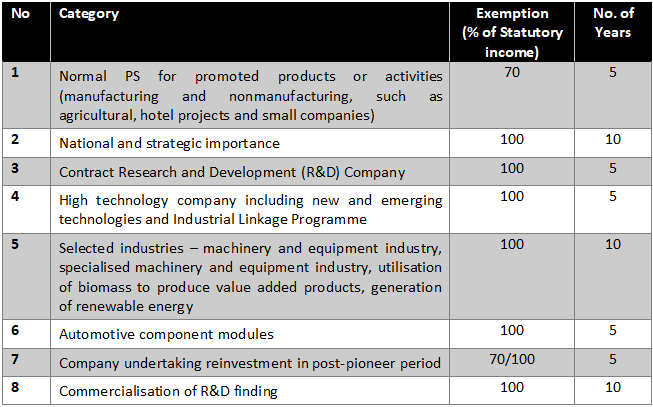

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Posting Komentar untuk "What Is Investment Tax Allowance Malaysia"